Contents

Additionally, government insurance programs like FHA ensure that lenders get paid, even if a borrower defaults on the loan down the road. So in many cases, lenders bear very little long-term risk from the loans they produce. Refer back to the mantra above. Mortgage income requirements and monthly payment affordability are two different things.

FHA Loan Questions: Minimum Income Requirements. A reader asks, "Hello just want to know how much do my annual gross amount have to be to get approved for a FHA loan?" Two of the most common myths about fha home loans are that the FHA is only for first-time homebuyers and that FHA loans have a minimum income or maximum income requirement.

Fha Home Purchase Requirements Fha Loan Limits Florida 2016 Each year, the Federal Housing Finance Agency sets new loan limits for conforming loans and mortgages insured by the Federal Housing Administration. Find out what the conforming and FHA loan.Fha Multifamily Loan Requirements HUD Multi-Family Mortgage Guidelines On FHA Home Loans – HUD Multi-Family Mortgage Guidelines On FHA Home Loans. This BLOG On HUD Multi-Family Mortgage Guidelines On FHA Home Loans Was PUBLISHED On April 11th, 2019 HUD Multi-Family Mortgage Guidelines on 2 to 4 unit properties state home buyers can purchase multi-family units with FHA Loans with 3.5% down payment.HUD.gov / U.S. Department of Housing and Urban Development (HUD) – Yes, FHA has financing for mobile homes and factory-built housing. We have two loan products – one for those who own the land that the home is on and another for mobile homes that are – or will be – located in mobile home parks. Ask an FHA lender to tell you more about FHA loan products. Find an FHA lender. Need advice? Contact a HUD-approved.

· The Federal Housing Administration’s changes to its Project Capital Needs Assessment requirements are putting multifamily lenders in a squeeze at a time when wages are stagnant, job growth is.

· The Federal Housing Administration’s changes to its Project Capital Needs Assessment requirements are putting multifamily lenders in a squeeze at a time when wages are stagnant, job growth is.

Fha Bankruptcy Waiting Period 2015 FDIC Law, Regulations, Related Acts – Rules and Regulations – 360.1 Least-cost resolution. 360.2 Federal Home Loan banks as secured creditors. 360.3 priorities. 360.4 administrative expenses. 360.5 Definition of qualified financial contracts.

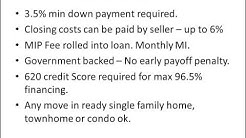

Annual premiums are included when calculating borrowers’ debt-to-income ratio, and the lower rates. offering lower-cost mortgages with down payment requirements as low as 3.5 percent, the FHA’s.

2015. For HECMs that closed before Aug. 31 with negative residual income, that could not be delivered prior to making the system change, FHA states that mortgagees may request a refund of MIP Late.

An FHA multifamily loan isn’t well-known, but it exists. It’s right for investors who want to purchase/build properties with 5+ units, but they’re not commonly used. Read our article for a breakdown of the costs, terms, and qualifications, as well as alternatives.

Cancel Pmi On Fha Loan Florida fha loan requirements florida fha home loan mortgage requirements – FHA Mortgage Source is Florida’s FHA loan leader – Serving all of Florida (Jacksonville FL, Orlando FL, Tampa FL, West Palm Beach FL, Clearwater FL, St. Petersburg FL, Pensacola FL, and Tallahassee fl) 7 days week! FHA Home Loan Mortgage Requirements can be found at our web site. Located in a rural location of Florida?When can I remove private mortgage insurance (PMI) from my loan? – Answer: Federal law provides rights to remove PMI for many mortgages under certain circumstances. Some lenders and servicers may also allow for earlier removal of PMI under their own standards. The federal homeowners protection act (hpa) provides rights to remove Private Mortgage Insurance (PMI) under certain circumstances. The law generally provides two ways to remove PMI from your home loan: (1) requesting PMI cancellation or (2) automatic or final PMI termination.

FHA Loan Requirements Important FHA Guidelines for Borrowers. The FHA, or Federal Housing Administration, provides mortgage insurance on loans made by FHA-approved lenders. FHA insures these loans on single family and multi-family homes in the United States and its territories.

What Are The Income Requirements For An FHA Loan? What are the income requirements for an FHA loan? Some aren’t sure if they earn enough to qualify for an FHA mortgage, and others are worried that they might earn "too much" to qualify, mistakenly believing that FHA loans are only for people within a certain income bracket.

Bank Of America Fha Loan Qualifications Fha Changes 2015 Fha Mip Changes 2015 | Texasclerks – FHA Guideline Changes 2015-2016 – The FHA home loan program has some new rules and guidelines starting september 14th 2015 for all approved fha banks, lenders and brokers. These FHA Guideline Changes 2015-2016 should be noted for any home buyers that wish to utilize the fha mortgage program in 2016.FHA mortgages from CitiMortgage feature low down payment options and flexible financial requirements so it’s easier. Ideal.

FHA.com Reviews. FHA.com is a one-stop resource for homebuyers who want to make the best decisions when it comes to their mortgage. With our detailed, mobile-friendly site, individuals can access information about different FHA products, the latest loan limits, and numerous other resources to make their homebuying experience easier.